Our Impact

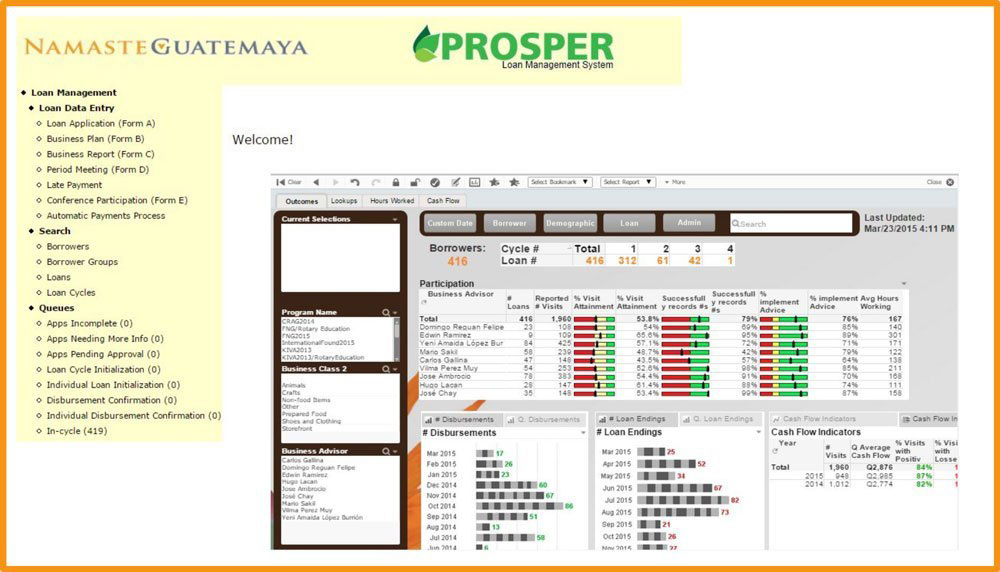

Namaste has a healthy obsession with measuring our impact. We use a custom-made online database called PROSPER (Poverty Reduction Operating Software that Plans, Evaluates and Reports) developed specifically for us by Tenmast, a Kentucky-based software company. PROSPER stores more than 500 data points of information per client and w. On top of PROSPER sits QlikView, the leading business intelligence software system worldwide. Namaste uses this combined system to analyze not only our clients’ performance but our team’s performance as well.

While most microfinance institutions are solely interested in collecting interest payments, the primary indicator we use to monitor our impact is each woman’s change in profit in our program. In 2022, our our graduates increased their profits by an average of 86%!

Business Advising

Business Advising- The most potent aspect of Namaste’s Creating Prosperity Program is the individualized business mentorship we provide to our clients. Each Namaste client is assigned a professional business advisor for the duration of their loan cycle. Business advisors are local community leaders, well versed in the local economy and also the indigenous languages of the region. Each month, the client and advisor meet to discuss the details of the business, focusing on cash-flow analysis, detailed record keeping, and strategic planning. Throughout the cycle, Namaste Business Advisors work with their clients to define specific business objectives, outlining important steps to take to achieve their dreams. The Namaste training methodology – highly sensitive to literacy rates and cultural needs – is crafted to keep each client on track.

Namaste clients have implemented 88% of the recommendations they’ve received from their Business Advisors.

Financial Literacy Training

Financial literacy training is an extremely important aspect of teaching our clients how to run successful businesses. Through our programs, each Namaste Entrepreneur learns important cash management techniques, such as separating business money from personal money.

Implemented by our Business Advisors, the Financial Literacy programs are culturally sensitive, and designed through a participatory approach. This allows the women with whom we work to get the most out of the sessions and learn valuable and applicable skills for their future and current businesses.

Customized Micro-loans

To realize the goals in her business plan, Namaste provides each client with a micro-loan to invest in her business. Together with our financial literacy training and business advising, women use loan funds to bring their businesses to the next level.

84% of Namaste’s clients achieved their business goals in 2022.

Namaste’s Annual Businesswomen’s Conference

Every year in March, Namaste brings 100 clients to our annual conference in beautiful Lake Atitlan to participate in women’s empowerment workshops, network, and celebrate their accomplishments.

Each year since 2007, Namaste brings 100 clients to our Annual Businesswomen’s Conference in Panajachel, sponsored by our long-time partner, The Huge Difference Fund. Over 1,000 Namaste clients have met along the shores of Lake Atitlan for this powerful 3-day event featuring learning, cultural exchanges, and peer-based entrepreneurial support. Travel, personal development workshops, networking lunches, and boat cruises are unfathomable luxuries for most Namaste clients until they attend our annual conference.

Though the conference does give our clients a rare reprieve from their responsibilities, the most potent aspect of the event is that participants experience themselves in a different context. They meet other women who, like them, work hard and make meaningful contributions to their families. Conference workshops support their growth as entrepreneurs and empowered women. Nourished by connection, learning, laughter, dancing, and reflection on their accomplishments, our clients return to their homes and businesses with a newfound sense of pride. Want to participate in our 2024 conference? Click here.

Namaste’s Savings Club

The majority of Namaste’s clients don’t have savings or any sort of safety net to cover unforeseen expenses, leaving them vulnerable to financial ruin if they or someone in their family gets in an accident or gets sick. Namaste’s savings club incentivizes clients to save 10% of their monthly payments by providing a 50% match.

Technology

Namaste utilizes outstanding technology to monitor and evaluate our organization’s performance, and we also support our clients in leveraging technology for their businesses. While the majority of Namaste’s clients have smartphones, many lack digital literacy skills and are apprehensive about using technology. That said, the pandemic presented an opportunity for Namaste to help bridge the digital divide for our clients.

Namaste has created digital financial literacy training, supported our clients using social media to communicate with their customers, and trained clients to operate a business planning app on Namaste’s tablets. We continue to use data to inform our programmatic interventions to ensure we present clients with practical and culturally appropriate tech solutions.